INVESTOR ALERT! Positive News For Flipping Houses In 2016! TEAM THAYER #realestate #investing #investortips #housing #oregon

Homes bought specifically to resell within a year for profit, or flipped homes, recently captured the industry's attention with major gains in store for investors.

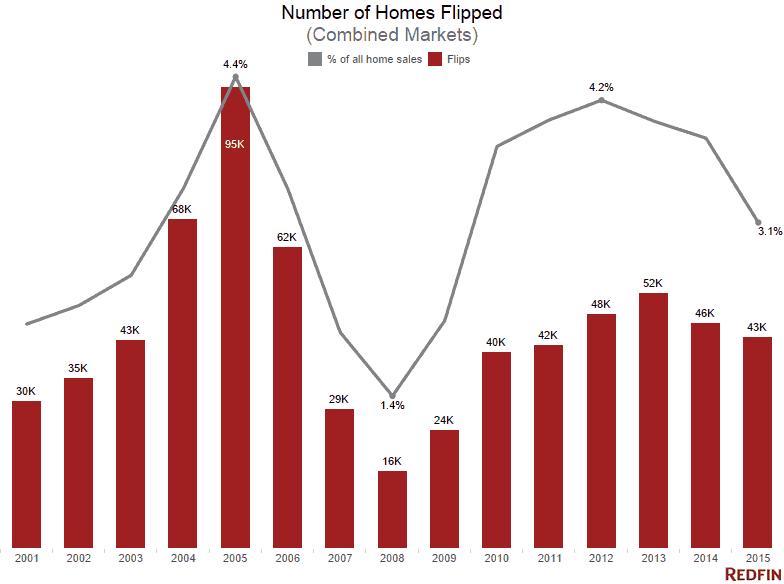

According to a Redfin report, flipped homes made up an estimated 3.1 percent (43,000) of all home sales in 2015, down from 46,000 in 2014. Flips were at their highest in 2005 during the housing boom at 4.4 percent (95,000) and lowest in 2008 at 1.4 percent (16,000) during the bust.

"Even though it reflects such a small portion of sales, flipping activity can tell us a lot about overall market conditions," Redfin said. "Investing in a flip involves making a bet on the market. It’s a vote of confidence that prices will appreciate, that value added by any improvements will outweigh the costs, and that a buyer will want to buy the home for the higher asking price."

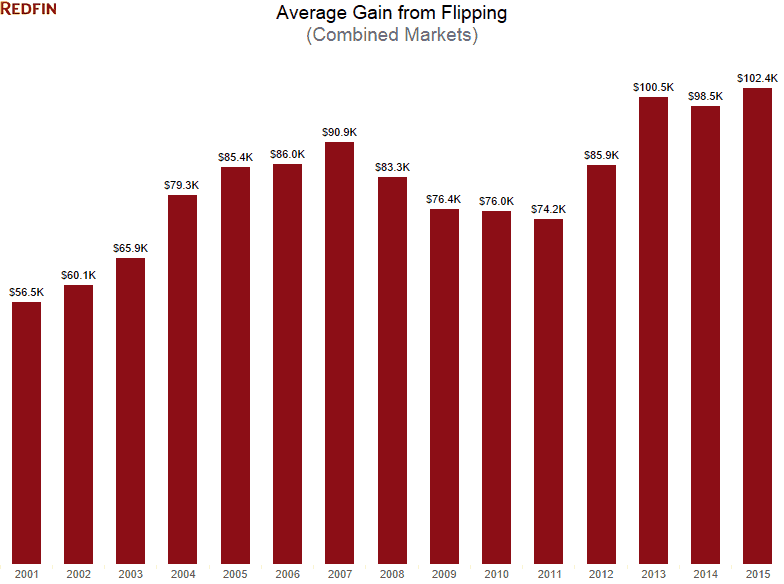

The report found that home flippers gained the most from their flips in 2015 at an average of $102,400 per home, the highest gain ever recorded. Redfin noted that "gain does not equal profit as we do not know how much each flipper invested in renovations and updates."

Rick Sharga, Chief Marketing Officer at Ten-X, sat down with DS News to reveal what the uptick in home flipping means for the housing market and what new opportunities lie ahead for home flippers in the market.

What does this news mean for home flippers? The housing market as whole?

Sharga: One of the things not mentioned in the Redfin report is that there will likely be an increase in the number of properties coming to market that are ideal homes for flippers. States with long, cumbersome judicial foreclosure processes—New York, New Jersey, Florida, Illinois and Maryland, for example—are seeing increased REO activity, as properties that have been in foreclosure for years are finally working their way through the system. These homes are often in a state of disrepair that's too severe for typical owner-occupants, but because they'll also be deeply discounted, they represent terrific opportunities for flippers.

This is good news for the housing market for a few reasons. First, it will provide desperately-needed inventory at a time when the supply of homes for sale nationally languishes at about four months. Given the types of properties involved, these flips might even provide some opportunities for first-time homebuyers, who have been largely missing in action during the housing recovery. Finally, it will transform distressed, deteriorating properties into move-in ready homes that will sell at or close to full market value, protecting the home prices of other properties in the neighborhood.

Although flips were not bad in 2015, they are still below the housing boom numbers. Is there any chance they will reach this level again? Under what conditions?

Sharga: As long as home prices continue to rise, especially in a market where there is extremely limited inventory of existing homes for sale, where demand seems to be outpacing supply—there will be opportunities for flippers. The majority of investors who buy properties using our Auction.com platform tell us that they plan to fix and flip, rather than hold for rent, so the market is primed for flipping to grow more than it already has.

It's not likely, however, that we'll see flipping hit the volume it hit during the housing boom of the mid-2000s. Flipping, like a lot of other trends that we saw in the housing market then, was driven by conditions that, fortunately, no longer exist: massive, rapid home price appreciation; bad loans made on these over-priced properties; and far too many would-be real estate investors getting in over their heads.

Justin Lee Thayer is Lane counties expert in market analysis for real estate investors. Call Justin @ 541-543-7287